Alliance experts can help you with your countrys arrangements. Double deduction for promotion of exports.

Export Incentive Infrastructure Allowance Double Deduction For Prom

Expenses for the cost of maintaining sales offices overseas for the promotion of exports from Malaysia.

. You can deduct promotion costs if they relate to your company and you expect to gain business from them in the future. Double deduction stated above. A cost that a business incurs to make its products or services better known to consumers usually in the form of giveaways.

Exemption of income for increased exports of. Double deduction for qualifying expenses in promoting export of. For example you can deduct the cost of sponsoring an event.

Single deduction under Income Tax Deduction For Promotion of Exports No2 Rules 2002 PUA1162002 and Income Tax Deduction For Promotion of Exports No3 Rules 2002 PUA 1172002 respectively. Income Tax Deduction for Promotion of Export No. Further deduction on overseas promotion of tourism in Malaysia-Tour operators.

Research approved by minister Expenses incurred within 10y from date of approval Incurred on RD activities undertaken overseas Research institutes or companies. The calculation of a taxpayers FDII involves a complex and definition - heavy formula. Type of Expenses Dealt with in Paragraph of this PR Legislation Deduction available Paragraph 621 a Publicity advertisements outside Malaysia b Provision of samples c Research on export market.

DOUBLE DEDUCTION OF EXPENSES. The IRS considers promotion expenses to be tax. And b The company must be owned more than 50 by the registered proprietor Refer to section B52 for details of eligible outgoings and expenses.

In this regard the Public Ruling replaces the Guidelines on Deduction for Promotion of Exports. To arrive at FDII a taxpayer first computes its deemed. Corporate Office Level 16 Menara Atlan 161B Jalan Ampang 50450 Kuala Lumpur.

Sekatan ke atas Kebolehpotongan Faedah Seksyen 140C Akta Cukai Pendapatan 1967 - Edisi Bahasa Inggeris Sahaja. 16 qualifying services b. Healthcare services provided in Malaysia to foreign clients 2.

Tax exemption on export sales. 02 03 2022 11. Double deduction With effect from year of assessment 2006 PUA 142007 allows for twice the amount of expenses on registration of patents trademarks or product licensing overseas.

DOUBLE DEDUCTIONS FOR PROMOTION OF EXPORT The promotion of exports is a double deduction of revenue expenses incurred. Sections 14B and 14C of the ITA provide a double deduction for a approved overseas and domestic market trade fair expenses b overseas trade office maintenance c approved publications and advertising and. If the registered proprietor does not claim for the double deduction stated above.

Expenses that qualify for Double Deductions. ALLOWABLE DISALLOWABLE EXPENSES YA2021 PARTICULARS SEC Allow. For details refer to paragraph 4.

Benefits of Double Deductions. PUA 1712007 YA 2007 14. This is good for the trade balance and for the overall economy.

The PR goes on to list the expenses that qualify for the respective deductions and provides several examples. Industrial Adjustment Allowance IAA Double Deduction For Promotion Of Exports. The expenditure cap for the automatic double tax deduction under the scheme is 100000 per Year of Assessment YA for qualifying expenses incurred from 1 Apr 2012 to YA 2018 and 150000 per YA for those incurred from YA 2019 to 31 Dec 2025.

Third party costs incurred to design and produce digital collaterals and promotion materials for. All resident companies engaged in promotions exports outside Malaysia will qualify for the deduction 6. For example you can deduct the cost of printing business cards.

The company must be 70. Specifically under Sec. 250 a 1 A a domestic C corporation can claim a deduction equal to 375 of its FDII this will decrease to 21875 for tax years beginning after Dec.

Outgoings and expenses incurred for promotion of export of services. ACA IA of 20 AA of 40 on expenses incurred on the purchase of new locally assembled excursion bus. Jadual Average Lending Rate Bank Negara Malaysia Seksyen 140B.

Singapore for example has the Double Tax Deduction on business development expenses made overseas. Cash contribution to approved. Antifriction Bearings 199293.

A resident company is given a double deduction in respect of approved outgoings and expenses under the PIA 1986 Schedule Income Tax Promotion of Exports Rules 1986. Export of services 1. Expenses incurred for the promotion of exports by pioneer companies.

Promotion of a brand name means making a name internationally known and therefore would include such expenditure as bill-boards in international airports or highways. Your advertising expenses must be directly related to your business. Double Deduction of Export Promotion Expenses under the Income Tax Act ITA Section 14B and 14C.

A 1172002 as a follow-up to the trade or investment mission. The expenses incurred are given as a further deduction in arriving at the adjusted income. Outgoings and expenses incurred for promotion of export of services The incentive has been extended to partnerships.

DD Insurance premium for importexport cargo from company in Malaysia Expenses for approved training Remuneration for disabled employees- salary and bonus Approved research and development expenses Overseas. 3 Rules 2002 PU. Double deduction for qualifying expenses for the export of goods or agricultural produce manufactured produced assembled processed packed graded or sorted in Malaysia.

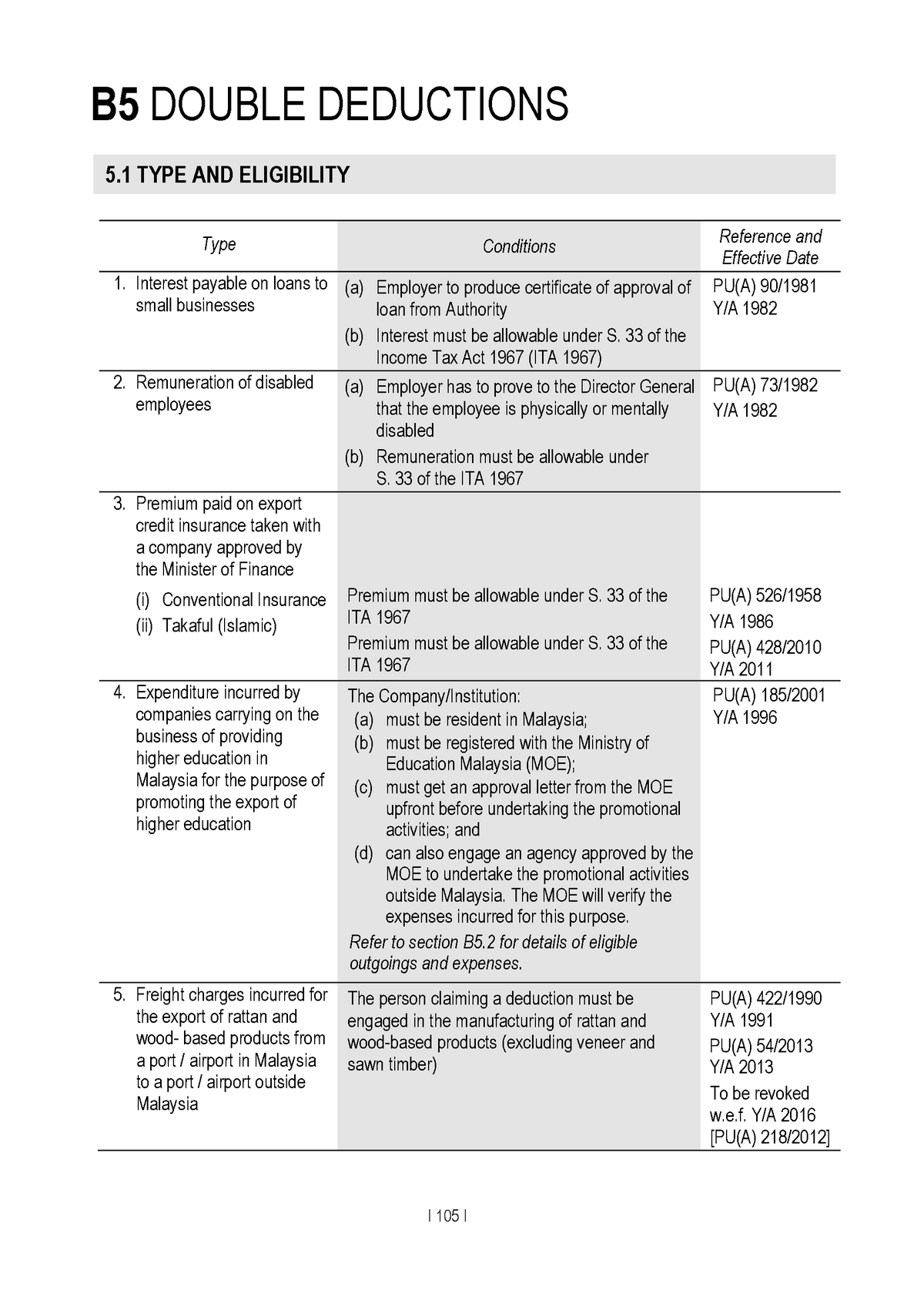

The PR classifies the available deductions into three categories. DOUBLE DEDUCTION Remuneration of disabled employees Premium paid on export credit insurance taken with a company approved by MOF Research expenditure. Double deduction for costs in obtaining international quality standard certification-.

The following is a summary of the types of deduction available with legislative authority. Export promotion is used by many countries and regions to promote the goods and services from their companies abroad. Brand Promotion Advertising - Expenditure incurred promoting an export quality standard Malaysian owned product is subject to double tax deduction.

And iii double deduction. TYPES OF EXPENDITURE QUALIFYING FOR FURTHER DEDUCTION FOR PROMOTION OF EXPORT. The company must be owned more than 50 by the registered proprietor of the Malaysian brand name.

Shopware 6 Settings Import Export

Export Incentive Infrastructure Allowance Double Deduction For Prom

Shopware 6 Settings Import Export

Foreign Trade Policy Export Promotion Schemes

Egypt Agricultural Export Strategy Report Full Imc Egypt

Export Incentive Infrastructure Allowance Double Deduction For Prom

Full Article Export Promotion Policies And The Performance Of Firms Evidence From Bonded Zones In Indonesia

Pdf Alternative Industrial Strategies And Effects Of Fiscal Incentives And Trade Policy In Achieving Employment Objectives In Malaysian Industrialisation Semantic Scholar

Shopware 6 Settings Import Export

Ultimate Guide To Shopware 6 Export Firebear

Double Deduction B5 Double Deductions Type Conditions Reference And Effective Date Interest Studocu

Ultimate Guide To Shopware 6 Export Firebear